Top 5 Forex Brokers in India

Forex Trading in India

As more and more investors look to diversify their portfolios with some FX exposure, the interest in forex trading has rapidly grown among Indian retail traders. Here trading takes place with the change in exchange rates, which means buying of one currency and selling on another. An Insight into Forex Trading in India: A Brief Overview On what all you have to know about it including how do people trade forex, Why there is an increase even with legal restrictions; Countries that has a good growth of forex trading.

What is Forex Trading?

Forex trading is the process of selling one currency in exchange for another, to gain from movements and fluctuations in rates. The forex market presents a unique opportunity, as unlike stock markets it is decentralized and operates 24 hours a day five times in the week due to global time zones. This competition has multiple participants starting from banks, financial institutions, corporations and ending with individual traders.

The idea is to purchase a currency at a low price and the other way around — hence traders want higher prices. If a trader expects the value of an issued currency to grow (for instance, traders who foresee US dollar strengthening against Indian Rupee will buy USD/INR) Forex market is the largest financial market in the entire world with more than $6 trillion daily trading volume provides profitable opportunities as well as full of risks.

Growth of Forex Trading in India

There are many factors which has been contributing to the exponential growth of forex trading in India, and few among them include:

1. Growing Internet Reach: The internet is now accessible to over 700 million Indians and they can trade on the online trading platforms a lot easier than ever before.

2. Online Trading Platforms Become More Available: The introduction of friendly-on-the-pocket online trading platforms has changed the scope of the financial markets, forex included. These include providing real-time data of forex, trading tools and mobile apps so that it can be easily accessed by both newbies as well experienced traders.

3. Rising Global Financial Markets Interest: Indian investors are becoming more aware of global financial market trends. Thus, developments in interest rates and inflation among others are taken into account to assess the future currency value leading to new trading opportunities.

4. Diversifying Investment Portfolios: It is common among the Indian investors who wish to explore beyond stocks,bonds and real estate. Forex trading is one more possibility to spend internationally in global foreign exchange transactions.

5. Presence of learning resources: The access offered by various online tutorials, webinars and other means has also allowed a wider population of India to learn how to trade in the forex market which is helpful for them so as they can smartly make their moves.

A blend of all these factors has made the growth of forex trading in India astronomical fast.

Legal Aspects of Forex Trading in India

In India, the legality of forex trading is a factor more with respect to online activity and using websites instead of local brokers. Regulatory Bodies in India for Trading Forex

1. RBI Regulations: Apart from JPYINR, the RBI legally allows forex trading in a few specified currency pairs that USD-INR involved called INRMajors. At present, only the four currency pairs are permitted for trade in India which includes USD/INR (US Dollar /Indian Rupee), EUR/INR (Euro / Indian Rupee), GBP/ INR( British Pound sterling ) and JPY??. All other trading beyond these pairs is prohibited.

2. Concerning SEBI regulations: The forex brokers based in India have to adhere to the rules and regulation as prescribed by SEBI. To make trading fair, transparent and more safer all brokers follow strong regulations. Forex trading services are legally provided in India by only those brokers who have SEBI registration.

3. FEMA Compliance: All foreign exchange transactions in India are governed by the Foreign Exchange Management Act (FEMA). Both these points are forbidden if you trade any forex pair on foreignbased platforms as an Indian citizen according to FEMA. Remembering if ever practiced, in a few cases it causes penalties or fines and imprisonment.

4. Regulated Brokers : To trade forex legally in India you have to use the services of a broker that is allowed by SEBI, and RBI on their platforms. The global reach of cryptocurrency deposits cannot be underestimated and paying for binary options with bitcoin has made the trading scene much safer.

What to Look for in a Forex Broker in India?

The common aspect between all forex traders is that they trade with the use of a brokerage. Take note of the following fundamental elements:

Regulatory Compliance: You must make sure that the broker is registered with SEBI or any other trustable financial authority. Regulatory control provides strict operational norms that traders are not paid for deceiving and their assets have the appropriate security protection. It is better to choose an RBI authorized forex broker for lawful and safe trading.

Trading Platforms and Tools: So, trading platforms should be preferred but ensure that these will provide the kind of practical tools to execute trade efficiently. The platform must have a good user interface and also offer you trading tools such as live technical indicators, charts (candlestick) patterns & customizable interfaces. Metatrader 4 and Metatrader 5 — these platforms are popular because they have complex analytical tools, in addition to automatic trading functionality, this makes it possible for both experienced traders and beginners.

Fees and Commissions: Find out from the broker about spreads (the difference between buying prices and selling) are charged on a trade, as well as other commissions. There needs to be transparency in pricing, and competitiveness may not always work for you. Differentiation is the key here when selecting brokers! Mind the other expenses like withdrawal fees, inactivity charges or overnight swap fees that can contribute to your total cost of trading.

Customer Support: Customer support is at the heart of trading, especially for those new to this whole world of forex trade complexities. Search for brokers that provide 24/7 support via live chat, email and phone. Responsive customer care helps in issues being resolved quickly if any and a hassle-free trading experience.

This way, you can choose an appropriate forex broker in India by considering all these factors.

We are pleased to represent brokers that accept Indian Rupee (INR) for Indian traders, making it easy to deposit and withdraw funds. And The brokers who have obtained approval from the Indian government. Beside these brokers have a good reputation among Indian traders as best forex brokers in India.

-

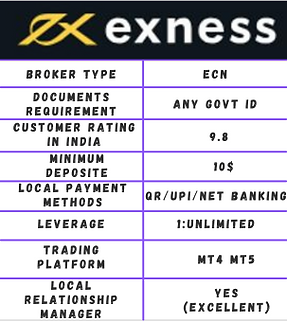

EXNESS holding very strong licence and regulation. EXNESS licensed by reputable financial regulatory authorities such as the CySEC/FSC/FSA/FSCA/FCA/BVI . This ensures maximum security of the trader’s funds and protection from any fraudulent activities.

-

To opening an account with Exness, Indian Citizens will need to provide only government-issued ID like Adhar front and back side clear photo.

-

Minimum deposit of just 1$ in Indian Rupee (INR) with UPI, PhonePay, Gpay, Debit / Credit Card, Local Exness Agent and Internet Banking.

-

With a customer review rating of 9.7 out of 10, it is easy to see why EXNESS is so popular. Clients benefit from competitive leverage, fast order execution, deposit withdraw, low commissions. Zero requotes, no minimum order distance restriction. MT4, MT5 platforms. experts technical analysis and social trading . The broker is also renowned for its customer service and ranked at top among the best forex broker in India.

-

ICMarkets holding very strong licence and regulation. ICMarkets licensed by reputable financial regulatory authorities such as the SCB/FSCA/CySEC/SD/FSA/ASIC . This ensures maximum security of the trader’s funds and protection from any fraudulent activities.

-

To opening an account with ICMarkets, Indian Citizens will need to provide government-issued ID and a recent bank statement. Your ID must be valid and up to date, and your bank statement must not be more than 3 months old.

-

Minimum deposit of just 10$ in Indian Rupee (INR) with Astropay & Crypto.

-

With a customer review rating of 9.6 out of 10, it is easy to see why this forex broker is so popular. Clients benefit from competitive spreads, fast order execution, deposit withdraw, low commissions. Zero requotes, no minimum order distance restriction. MT4, MT5, cTrader platforms. and a wide range of trading instruments like Trading Central, Autochartist, social trading . The broker has established its position as the top forex broker in Indian.

-

OCTAFX licensed by reputable financial regulatory authorities such as the CySEC/FSA/VFSC.

-

To opening an account with OCTAFX, Indian Citizens will need to provide only government-issued ID and a recent bank statement.

-

Minimum deposit of just 25$ in Indian Rupee (INR) with QR, UPI, Net Banking Debit / Credit Card and Internet Banking. Enjoy 50% deposit bonus on every deposit.

-

With a customer review rating of 9.2 out of 10, it is easy to see that OCTAFX also a popular forex broker in India. Clients benefit from fast order execution, deposit withdraw, MT4, MT5 platforms. experts technical analysis and copy trading .

-

FPMarkets licensed by reputable financial regulatory authorities such as the ASIC/AFS//CySEC/SVGFSA /FSCA . This ensures maximum security of the trader’s funds and protection from any fraudulent activities.

-

To opening an account with FPMarkets, Indian traders need to provide government-issued ID and a recent bank statement.

-

The minimum deposit for this forex broker is only $10, making it an affordable option for Indian INR with UPI, Netbanking and all bank cards .

-

FPMarkets is best broker for Indian traders. FPMarkets offers easy user interface, tight spread, low deposit, wide methods for deposit option, making it perfect for Indian. With a score of 9 out of 10, it is clear that they provide a reliable and comprehensive service. In a single word, this is a great broker for Indiian traders.

-

Vantage Markets licensed by reputable financial regulatory authorities such as the ASIC/AFSL/CIMA/FCA /VFSC . This ensures maximum security of the trader’s funds and protection from any fraudulent activities.

-

To opening an account with Vantage Markets, Indian traders need to provide government-issued ID and a recent bank statement.

-

The minimum deposit for this forex broker is only $10, making it an affordable option for Indian INR with UPI, Netbanking and all bank cards .

-

Vantage Markets is reputated forex broker for Indian traders. Vantage Markets easy trading platfrom, tight spread, low deposit, wide methods for deposit option, making it perfect for Indian. With a score of 8.8 out of 10, it is clear that they provide a reliable and comprehensive service. In a single word, this is a great broker for Indiian traders.

Legal Forex Trading Brokers in India

Importance of RBI Approval

The Reserve Bank of India (RBI) is the main regulatory body that oversees forex trading in India. That all forex transactions conducted in the country are compliant with FEMA (Foreign Exchange Management Act) and thus weed out illegal activities.

Forex Brokers accepted by RBI in India

RBI Approved Forex Brokers in India with the likes of ICICI Direct, HDFC Securities, Kotak Securities,Angel Broking and Zerodha which are forex brokers adhering to all legal formalities.

However, you can operate only in stocks and INR pairs.

The Right Broker to Choose?

Evaluating Your Trading Needs

Think about what you want to achieve with your trading, how much risk are you able to take and clearly define third party level of support and tools. A good example is if you are just starting out, find a broker that has educational tools and beginner-friendly platforms.

Brokers and Their Features What they offer you

Check that the broker provides your desired currency pair to trade, a user-friendly platform you are comfortable with and also Take into account its pricing because more often than not it results into hidden charges.

Advantages of Choosing an RBI Approved Forex Broker

Regulatory Protection

When trading with an RBI approved company, you have a legal recourse as per Indian law to claim your investments — it reduces the chance of any fraud or malpractice.

Reduced Risk of Fraud

Due to these strict compliance guidelines, the risk of fraudulent activities is minimized and it leads a more secure trading environment.

FAQs

1.What Is The Minimum Amount Required For Forex Trading In India ?

The minimum quantity varies by broker, but the majority of brokers ask for a preliminary down payment close to INR 500-1000/-.

2.Is Forex Trading Legal in India?

one will be having safety if he could make a deposit by USDT on our listed broker or RBI approved brokers with all the legal acumen with themselves then trading in forex is secure business In India

3.Which broker is best for forex trading in India?

So, the best broker would depend on your requirement but brokers Select a broker from our site and start trading today.

4.How can I Verify a Forex Broker is Approved by RBI?

Visit the website of your broker or get in touch with their customer service to know if they are regulated by RBI or SEBI.

5.What Are The Risks in Forex Trading In India The biggest dangers is on the market itself when operating, simply because of its high volatility and secondly that they are mainly sold with unregulated brokers.

6. Should I trade forex pair of international currencies in India?

If you need to trade international currency pairs use one of our recommended brokers then deposit with a crypto wallet and after that it is 100% safe. Failing which you can just trade the currency pairs allowed by RBI.

7. So, the answer to this is as simple as well how do I withdraw mone from Forex Broker in India?

On the broker platform you can make withdrawals to directly your bank account or crypto wallet.

8. Is It Legal to Trade Forex in India with Indian Rupees?

Yes you can trade the forex in INR pairs like USD/IN, EUR/INR, GBP.IN etc… also all other pair like EUR//USDGBP?USD,XAU\USD etc….

9. What are the Tax Implications of Forex Trading in India?

Profits from forex trading are subject to capital gains tax or business income tax, depending on the nature of the trading activity.